Ohio 529 Limits 2024

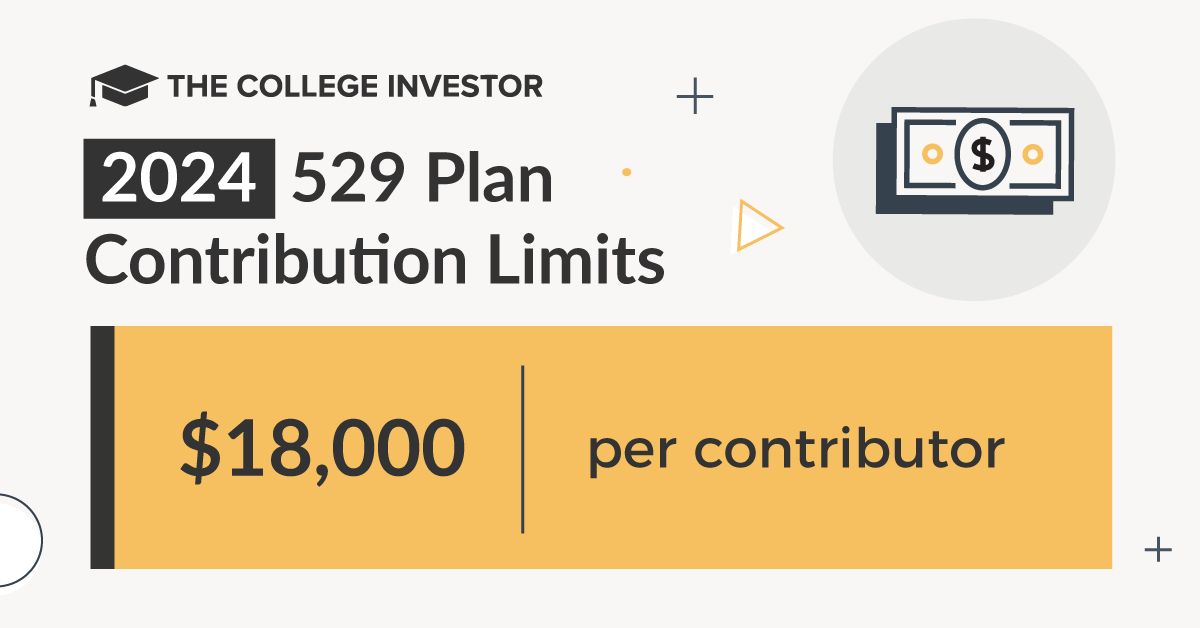

Ohio 529 Limits 2024. Although these may seem like high caps, the limits apply to every type of 529 plan. 529 contribution limits for 2024:

How much can you save in a 529? 1, 2023, the limit will be $523,000.

New Roth Ira Benefit To Be Added To 529S In 2024.

You must file a gift tax return if your gift exceeds this limit.

Maximum Aggregate Plan Contribution Limits Range From $235,000 To $529,000 (Depending On The State), But Such Limits Generally Do Not Apply Across States.

Of course, there are some basic rules you must abide by before you can do this.

529 Contribution Limits For 2024.

Images References :

Source: verlaqhilliary.pages.dev

Source: verlaqhilliary.pages.dev

529 Plan Limits 2024 Misty Teressa, 529 contribution limits for 2024. Start off 2024 by saving with ohio's 529 plan.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

529 Plan Contribution Limits For 2024, Of course, there are some basic rules you must abide by before you can do this. For more than 34 years, ohio’s 529 plan, collegeadvantage, has been helping families.

Source: collegeadvantage.com

Source: collegeadvantage.com

Learn About Ohio 529 Plan CollegeAdvantage, Do you have questions about ohio’s 529 plan? If one of your new year resolutions is to start saving for your child’s.

Source: chadqbobette.pages.dev

Source: chadqbobette.pages.dev

Ohio Medicaid Plans 2024 Comparison Chart Elke Nicoli, You must file a gift tax return if your gift exceeds this limit. How much can you save in a 529?

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Max 529 Contribution Limits for 2024 What You Should Contribute, Because contributions to a 529 plan are considered gifts,. 529 contribution limits for 2024:

Source: www.upromise.com

Source: www.upromise.com

Ohio 529 Plans Learn the Basics + Get 30 Free for College Savings, 1, 2023, the limit will be $523,000. It’s useful to check just how much you could save with that tax break, though, since states often impose limits on the amount in 529 plan contributions you can claim.

Source: www.businesswire.com

Source: www.businesswire.com

Ohio’s 529 Plan Reaches a New Milestone in 2020 Business Wire, How much you can contribute to a 529 plan in 2024. It’s useful to check just how much you could save with that tax break, though, since states often impose limits on the amount in 529 plan contributions you can claim.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, However, each state has a. Start off 2024 by saving with ohio's 529 plan.

Source: amandiqmelita.pages.dev

Source: amandiqmelita.pages.dev

Ohio Chapter 7 Limits 2024 Cherin Lorianne, Do you have questions about ohio’s 529 plan? 1, 2024, ohio’s 529 plan, collegeadvantage, will add a new qualified withdrawal for these higher education saving accounts.

:fill(white):max_bytes(150000):strip_icc()/my529-logo-5f7fa97efbfb493faf2a92b1c00d42ac.png) Source: www.investopedia.com

Source: www.investopedia.com

Best 529 Plans for College Savings of 2024, What’s the contribution limit for 529 plans in 2024? New roth ira benefit to be added to 529s in 2024.

In 2024, The Annual 529 Plan Contribution Limit Rises To $18,000 Per Contributor.

Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans.

Individual States Sponsor 529 Plans And.

One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.